what is the income tax rate in dallas texas

This is the total of state county and city sales tax rates. Did South Dakota v.

If you make 70000 a year living in the region of Texas USA you will be taxed 8387.

. For the 31000-51000 income group state and local. The Texas Franchise Tax. Your average tax rate is 1827 and your marginal tax rate is 2965.

Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax. Dallas County has one of the highest median property taxes in the United States and is ranked 194th of the 3143 counties in order of median property taxes. How Your Texas Paycheck Works.

Texas is No. 9 hours ago510 AM on Sep 8 2022 CDT. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and.

Both Texas tax brackets and the associated tax rates have not been changed since at least 2001. Your average tax rate is 165 and your marginal tax rate is 297. The minimum combined 2022 sales tax rate for Dallas Texas is 825.

2022 Texas Tax Rate. Start filing your tax return now. The rate increases to 075 for other non-exempt businesses.

What is the sales tax on 100 in Texas. What You Need to Know About Dallas Property Tax Rates. The County sales tax rate is 0.

Outlook for the 2023 Texas income tax rate is to remain unchanged at 0. The CFED chart is s based on 2007 data from the Institute on Taxation and Economic Policy and theres more information. The Dallas sales tax rate is.

Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also withholds taxes from your pay. This marginal tax rate means that your immediate additional income will be taxed at this rate. Texas income tax rate and tax brackets shown in the table below are based on income earned between January 1 2022 through December 31 2022.

Texas income tax rate. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. That means that your net pay will be 45925 per year or 3827 per month.

The Texas sales tax rate is currently 625. The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates.

Census Bureau Number of cities that have local income taxes. Because every little bit helps lets take a look. Your average tax rate is 1198 and your marginal tax rate is 22.

Texas Is Income Tax Free Texas is one of seven states with no personal income tax. 2021 Tax Year Tax Rate Info. Dallas County is a county located in the US.

Texas Income Tax Calculator 2021. Texas has no state-level income taxes although the Federal income tax still applies to income earned by Texas residents. Dallas County collects on average 218 of a propertys assessed fair market value as property tax.

It is the second-most populous county in Texas and the ninth-most populous in the United. The Dallas sales tax rate is 1. In terms of taxes Texas is one of the best states you can live in.

The Dallas County Commissioners Court is expected to approve a small decrease in its tax rate but property owners will likely still see a hike on this Octobers tax. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. Texas state income tax rate for 2021 is 0 because Texas does not collect a personal income tax.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. Ad Compare Your 2022 Tax Bracket vs.

As of the 2010 census the population was 2368139. If you make 55000 a year living in the region of Texas USA you will be taxed 9076. Your 2021 Tax Bracket To See Whats Been Adjusted.

The Texas income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022. Discover Helpful Information And Resources On Taxes From AARP. Theres no personal income tax and theres no residential real estate transfer tax one of only 12 states in the country.

Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax. TAX DAY IS APRIL 17th - There are 221 days left until taxes are due. 214 653-7888 Se Habla Español.

Calculating Sales Tax For example if someone were to purchase a necklace for 100 in an area of Texas that does not charge a local tax the calculation would be 625 multiplied by 100 for a sales. Detailed Texas state income tax rates and brackets are available on this page. In observance of Labor Day the Dallas County Office will be closed Monday September 5 2022.

10 Things To Know Before Moving To Dallas Tx

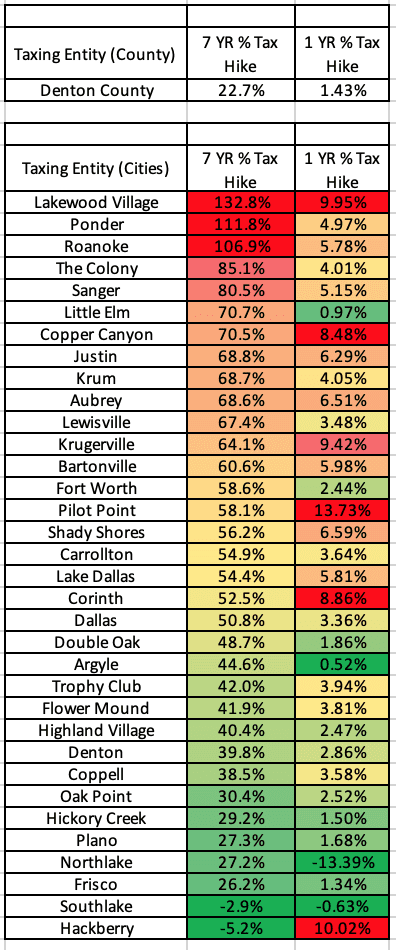

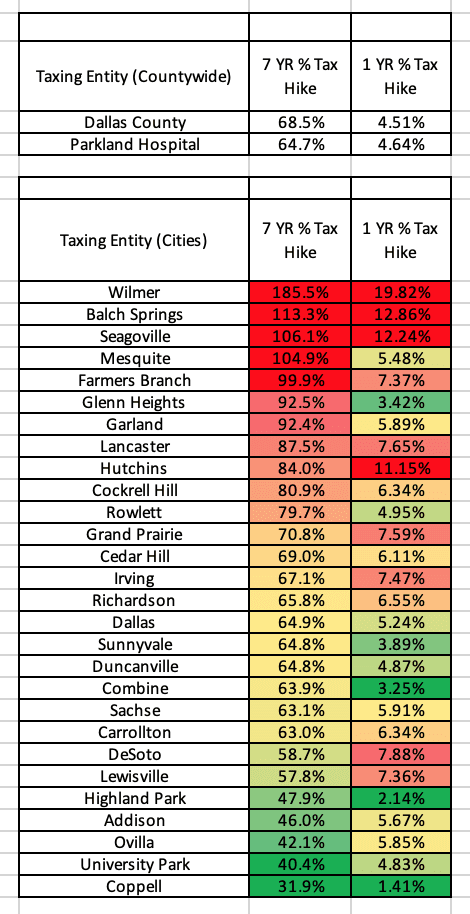

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Tax Practitioners Perceptions Regarding Fraudulent Earned Income Tax Credit Claims A Descriptive Case Study To Investigate The Phenomenon Of Tax Practitioner Case Study Tax Credits Phenomena

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Here S How Much Money You Take Home From A 75 000 Salary

Texas Income Tax Calculator Smartasset

Texas Income Tax Calculator Smartasset

Texas Income Tax Calculator Smartasset

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Bobby M Collins Is An Annuity Education Expert Who Has 30 Years Of Experience Helping Retirees Increase Incom In 2022 Annuity Retirement Strategies Dallas Fort Worth

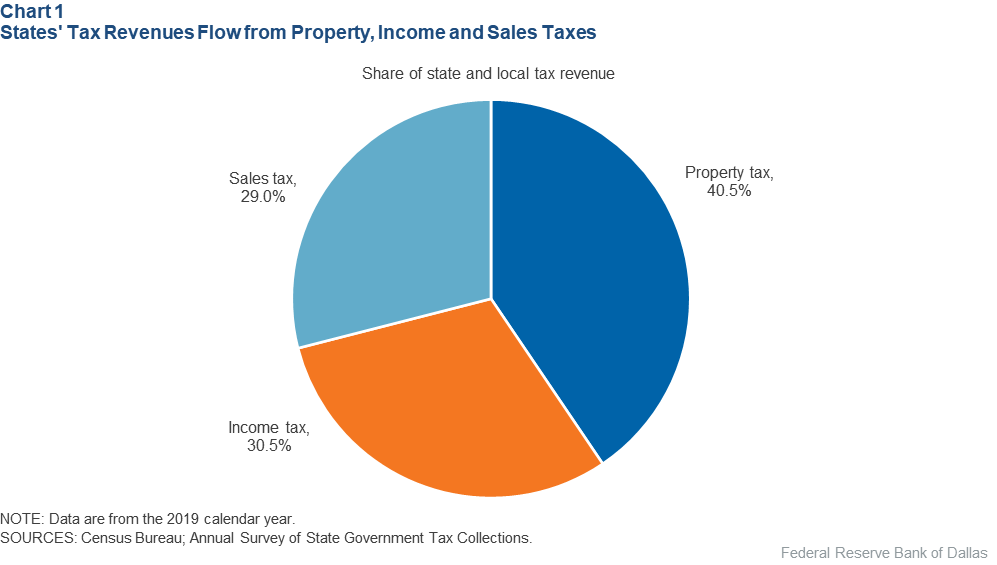

Federal Support Keeps State Budgets Including Texas Healthy Amid Tumult From Covid 19 Induced Economic Ills Dallasfed Org

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

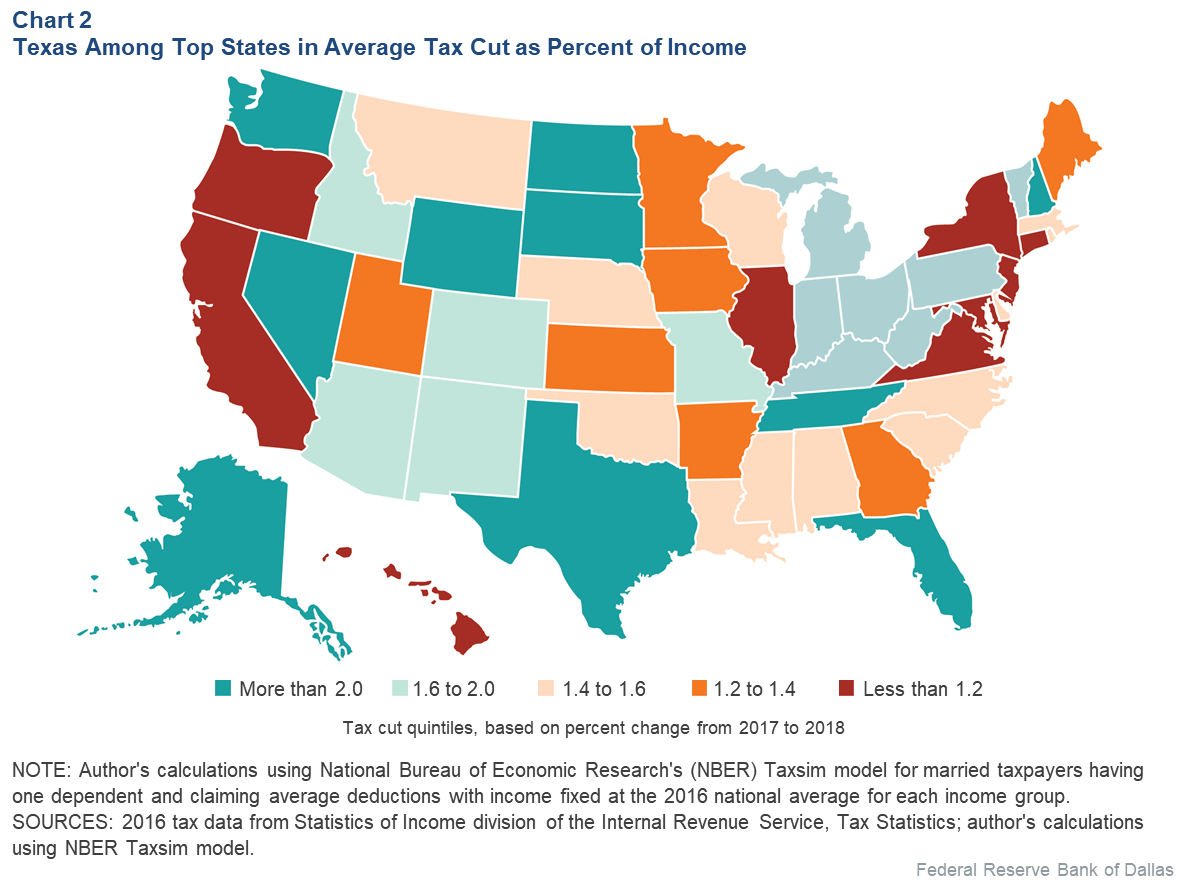

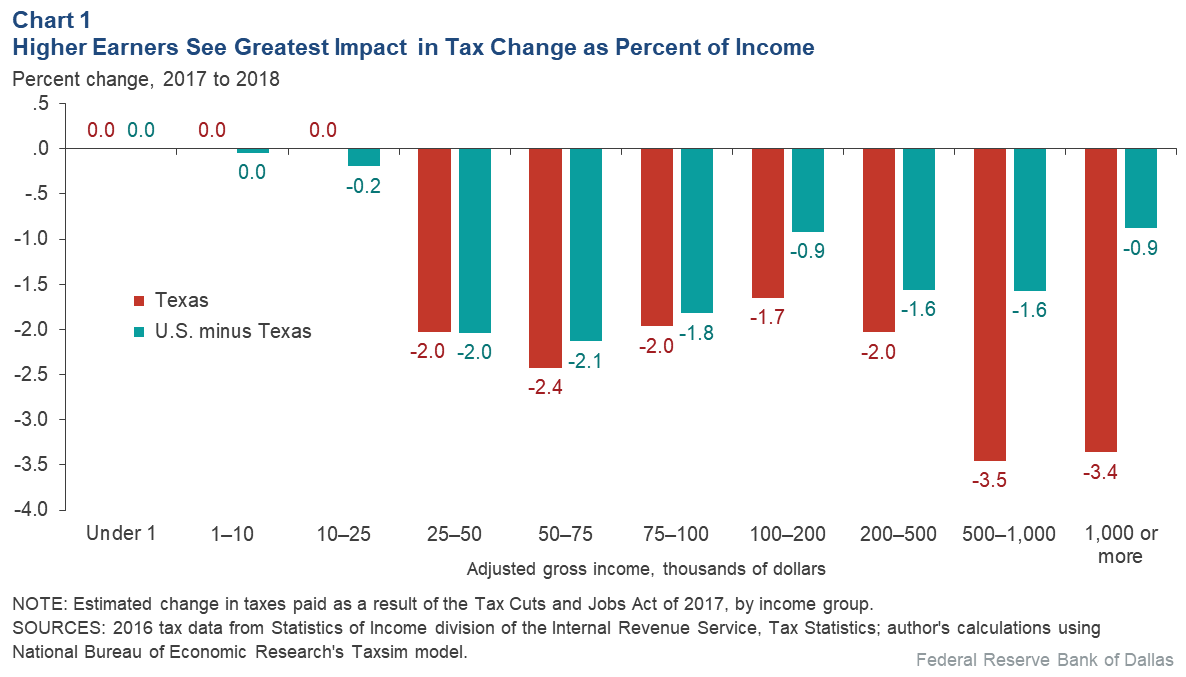

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org